Carbon credits are evolving from voluntary instruments used in the context of Corporate Social Responsibility (CSR) into strategic assets integrated into corporate management. This transition increasingly requires the direct involvement of Chief Financial Officers (CFOs), who are called upon to develop specific skills to assess and manage this new asset class while seizing emerging market opportunities.

Carbon Markets: Exponential Growth

The voluntary carbon market (VCM) is rapidly evolving: from a valuation of $2 billion in 2020, it is projected to exceed $180 billion by 2050. This growth is driven by corporate net-zero commitments, rising demand for carbon offsets, and increasingly stringent regulations.

Investing in carbon credits today means anticipating future compliance requirements, managing carbon price volatility, and supporting climate goals through assets that generate both environmental and reputational value.

Project Types and Methodologies

The market offers a wide range of opportunities through various methodologies, which can be divided into two main categories:

Nature-Based Solutions

Reforestation and Afforestation (ARR):

Restoration or creation of forests on degraded landImproved Forest Management (IFM):

Sustainable practices to enhance carbon sequestrationBlue Carbon (Mangroves and Wetlands):

Restoration of coastal ecosystems with high CO₂ storage capacity

Technological Solutions

Biochar

A solid carbon-rich material produced through biomass pyrolysis.Direct Air Capture (DAC)

Technologies that mechanically remove CO₂ directly from the atmosphere.Carbon Capture and Storage (CCS)

Industrial systems that capture and geologically store CO₂.

Risks to Manage, Strategies to Implement

Like any asset class, carbon credits come with specific risks:

Delivery Risk

Permanence Risk

Price Volatility

To mitigate these risks, companies can adopt appropriate risk management tools, such as:

-

Portfolio Diversification

Balanced portfolios with diverse project types, geographic locations, and certification standards.

-

Thorough Due Diligence

Project evaluation based on methodology, baseline assumptions, developer track record, and environmental, political, and reputational risks.

Managing uncertainty, building value

Our offer for your carbon management

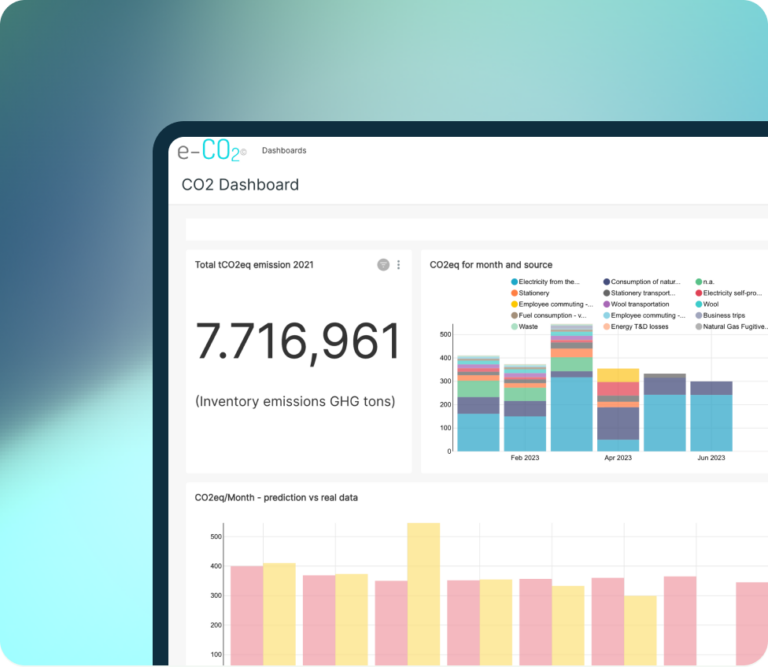

Managing carbon credits requires strategic vision, technical expertise and reliable tools.

With eco-sustainable.eu you turn uncertainty into value: we support you in generating quality credits, building resilient portfolios and rigorously evaluating projects to integrate carbon management into your climate strategy.

Do you want to move from an offsetting logic to an active and measurable strategy?

Talk to our team: we help you build a credible, integrated portfolio ready to face the future of the carbon market:

Our Success Stories

Discover the Carbon Credit origination projects developed by the ecosostenibile.eu team.

Request a Personalized ESG Consultation

We help companies develop effective ESG strategies, reduce emissions, ensure regulatory compliance, and transparently communicate their achievements—mitigating the risk of greenwashing.

Sustainability Metrics Analysis

We offer a green strategy that enhances ESG resources and processes, identifying critical areas and ensuring corporate management aligned with international standards and best practices.