China’s CSDS Sink the Omnibus: Why Companies Working with China Must Raise Their ESG Reporting Game

Condividi questo post

While the EU debates the Omnibus package to simplify (and delay) parts of CSRD/ESRS, China is moving fast with its Corporate Sustainability Disclosure Standards (CSDS): a national framework, explicit double materiality, full value chain coverage and a roadmap to full implementation by 2030.

For anyone doing business in, from or with China, the bar is going up, not down.

What’s Happening in Europe: the “Omnibus” and the CSRD Slowdown

In 2025 the European Commission launched an Omnibus package to “simplify” rules. During the legislative process, lawmakers are discussing:

narrowing the scope of companies required to report,

postponing deadlines,

softening some reporting requirements.

The European Parliament has also voted for deferrals on parts of the rules, especially for SMEs and non-PIEs, with first applications pushed back. The process is ongoing and final details will depend on co-legislators and Member States.

Implication: the EU risks a regulatory stop-and-go.

Exporters and companies with global supply chains must prepare for diverging scenarios across markets, avoiding under-compliance choices that may look convenient now but prove short-sighted.

What’s Happening in China: CSDS, a Clear and Forward-Looking Trajectory

China has published the CSDS Basic Standards and is developing thematic standards (for example on climate) with a gradual roadmap through 2030.

The model is inspired by and aligned with international frameworks (ISSB / IFRS S2) and, in terms of principles, it “converses” with the European CSRD/ESRS architecture – but with progressively mandatory and ambitious application.

Key features confirmed by official sources include:

Explicit double materiality: both financial impacts and impacts on environment and society.

Value chain scope: priority for listed and large companies, then extension to others; strong focus on upstream suppliers and downstream channels.

Phased implementation: gradual adoption with full national alignment by 2030.

Four Ways CSDS Raise the Bar (and Why They “Set the Pace”)

1. End-to-End Value Chain

Companies must assess upstream suppliers, downstream distributors and relevant partners.

This full value chain approach reduces information gaps and forces companies to build data governance across the entire chain, not just at the corporate perimeter.

2. A Dynamic (Not Static) Scope

Under CSDS, the supply chain perimeter must be re-examined when:

business models change,

risks evolve,

new regulations come into force,

sourcing locations or key inputs shift.

The reporting perimeter is “alive” and updated, not a one-off mapping exercise.

3. Connectivity with Financial Data

Sustainability disclosures (environmental and social KPIs) must be reconciled with:

costs and revenues,

assets and liabilities,

for example: emission costs, resource use, compliance costs.

This requires a step change in internal control, data quality and auditability, bringing ESG much closer to core financial reporting.

4. Double Materiality and Financial Integration

Impact and financial materiality are central. Companies must explain:

how ESG risks and opportunities affect performance, cash flow and financial position,

how sustainability topics translate into P&L, capex/opex and cash flow dynamics.

Key message:

With CSDS, companies working with China will not be able to “fix” ESG by simply adjusting supplier questionnaires. They will need to integrate ESG processes, controls and data into the core of corporate reporting.

“Does This Sound Familiar?”: The Parallel with ESRS

The ESRS were designed as the most detailed and integrated sustainability reporting framework in the world (double materiality, value chain scope, assurance, broad coverage).

If the EU loosens their application via the Omnibus, a paradox emerges:

many export-oriented companies will still need to keep high reporting standards to comply with Chinese CSDS requirements along the value chain.

Strategic risk: lowering ESG reporting ambition now may harm European exports in the coming years, when CSDS demands become stricter along supply chains.

What to Do Now: A Practical Checklist

To avoid being caught unprepared by CSDS while the EU debates Omnibus adjustments, companies should start now:

Map the value chain to at least tier 2/3

Identify and classify critical suppliers by ESG risk and dependency.

Align ESG data with financial accounting

Build reconciliations, controls and traceability between ESG KPIs and financial ledgers.

Prepare systems and internal controls to withstand assurance and audits.

Run a robust double materiality assessment

Define thresholds, sources, methodology.

Explicitly link material issues to P&L, capex/opex and cash flow.

Plan “2030-proof” compliance

Do not stop at the minimum EU requirement.

Set a target level of reporting already compatible with CSDS and ISSB.

How ecosostenibile.eu® Supports CSDS- and ESRS-Ready Reporting

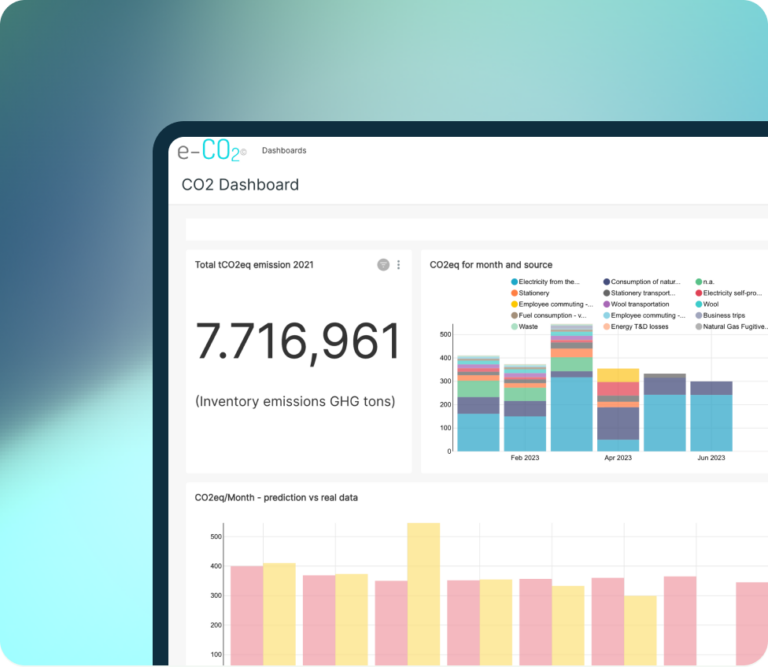

ecosostenibile.eu® Benefit Company is aligned with ESRS and fully supports every level of the value chain, upstream and downstream, through the eCO₂ platform:

Unified data model for ESG and financial KPIs, with reconciliations and controls.

Supply chain ESG: supplier onboarding, digital surveys, risk scoring and remediation plans.

Guided double materiality and full traceability into ESRS / ISSB / CSDS-ready reporting.

For companies that operate with China or expect to do so, the message is clear:

now is the moment to raise the bar, not to wait for minimal compliance.

Christian Sansoni