UAE and California: Two Worlds, One ESG Direction

Condividi questo post

ESG regulations are becoming stronger across the globe

When discussing ESG and sustainability regulations, the United Arab Emirates and California may not seem to have much in common. Yet, as of May 2024, both regions have taken major steps toward enforcing ESG metrics as mandatory for companies.

A clear signal: sustainability is no longer optional. It must be measurable, traceable, and in many cases, enforceable.

United Arab Emirates: ESG law in force since May 30, 2024

With Federal Decree-Law No. 11 of 2024, the UAE officially mandates the use of ESG metrics across all public and private organizations.

Key points of the UAE ESG regulation:

Universal applicability: the law applies to all entities, including free zones and all sectors.

Emissions reporting: companies must disclose Scope 1 and Scope 2 emissions, and Scope 3 where applicable.

Emissions reduction strategy: businesses must set a clear roadmap to reach net zero targets.

Sanctions: non-compliance can result in penalties of up to $1 million.

Offsetting: carbon credit markets are promoted as a tool for emissions offsetting.

From tracking regulations (CSRD, CSDDD, SFDR, CBAM) to assessing and mitigating sustainability risks, the CSO ensures robust reporting processes and business continuity in an ever-shifting political and economic landscape.

California: a new era for ESG corporate reporting

On the other side of the globe, California is reinforcing its climate governance framework through the new Senate Bill 219 (SB-219), which updates and unifies content from previous laws SB-253 and SB-261.

Highlights of the new SB-219 regulation:

Extended deadlines: the California Air Resources Board (CARB) now has until July 1, 2025 (instead of January 1) to adopt implementing regulations.

Scope 3 disclosure: companies must disclose Scope 3 emissions on a timeline to be defined by CARB, separate from Scope 1 and 2 deadlines.

Consolidated reporting: subsidiaries are exempt from reporting if data is already consolidated in the parent company’s statements.

Over 15,000 companies are expected to be affected, including many that operate across regions or are part of global supply chains.

ESG: If you can’t measure it, you can’t manage it

These legislative developments confirm a global trend: ESG measurement is now a fundamental pillar of corporate strategy.

If you can’t measure it, you can’t manage it.

If you can’t prove it, you can’t communicate it.

ESG compliance is no longer just about transparency. It’s now a competitive advantage, enabling access to green capital, boosting stakeholder trust, and strengthening resilience to regulatory and reputational risks.

Christian Sansoni

Looking for a smarter way to manage ESG compliance?

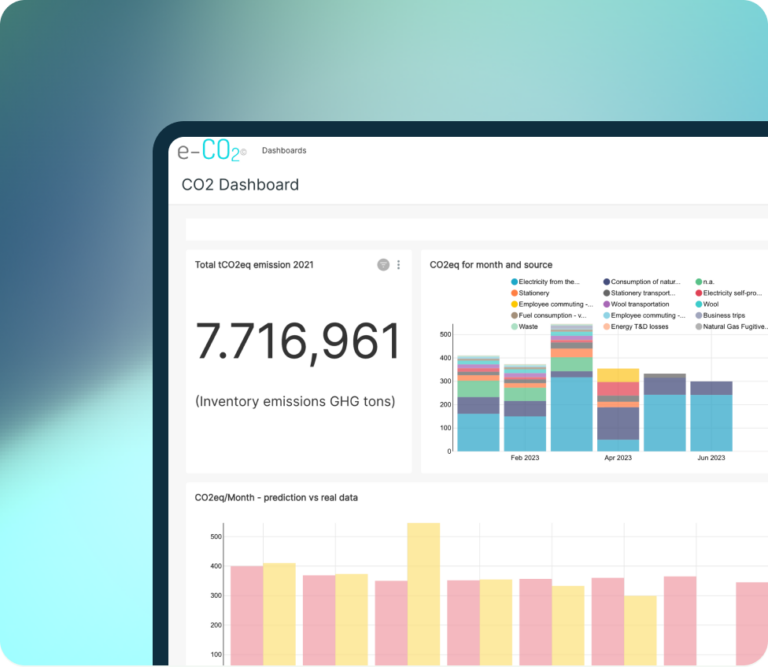

At ecosostenibile.eu®, a benefit company, we support businesses with a digital platform designed to measure and manage every ESG KPI